A bankable feasibility study (BFS) is an in-depth analysis conducted. To determine the viability of a project before significant financial investments are made. This comprehensive study provides detailed insights into various aspects. Of a project ensuring that all potential risks and returns are thoroughly evaluated. In essence a BFS serves as the foundation upon which investors and stakeholders can confidently base their decisions.

What is a Feasibility Study?

Basic Concept

A feasibility study is a preliminary assessment aimed at determining whether a proposed project or business venture is viable. It evaluates various factors such as technical feasibility, market potential and financial viability to provide a holistic view of the project’s potential success.

Different Types of Feasibility Studies

There are several types of feasibility studies. Each focusing on different aspects of a project:

- Technical Feasibility: Examines the technical resources and expertise required.

- Economic Feasibility: Analyzes the economic benefits versus costs.

- Legal Feasibility: Ensures compliance with legal and regulatory requirements.

- Operational Feasibility: Assesses the operational capacity to implement the project.

- Schedule Feasibility: Evaluates the timeline and deadlines for project completion.

Components of a Bankable Feasibility Study

A BFS is composed of several critical components. Each addressing a specific area of the project:

Market Analysis

- Understanding Market Demand: Analyzing current market trends and potential demand for the product or service.

- Competitor Analysis: Assessing the competitive landscape to identify potential competitors and market position.

- Pricing Strategy: Developing a pricing model that ensures profitability while remaining competitive.

Technical Analysis

- Project Design and Technology Selection: Choosing the appropriate technology and design to optimize project performance.

- Operational Plan: Outlining the day-to-day operations required to execute the project.

- Resource Requirements: Identifying the necessary resources including materials, labor, and equipment.

Financial Analysis

- Capital Expenditure (CapEx) and Operational Expenditure (OpEx): Estimating the initial and ongoing costs associated with the project.

- Profitability Projections: Forecasting potential revenue and profit margins.

- Financial Modeling and Sensitivity Analysis: Creating financial models to test various scenarios and their impact on profitability.

Environmental and Social Impact Assessment

- Environmental Considerations: Evaluating the environmental impact of the project and necessary mitigation measures.

- Social Impacts and Community Engagement: Assessing the project’s impact on local communities and strategies for positive engagement.

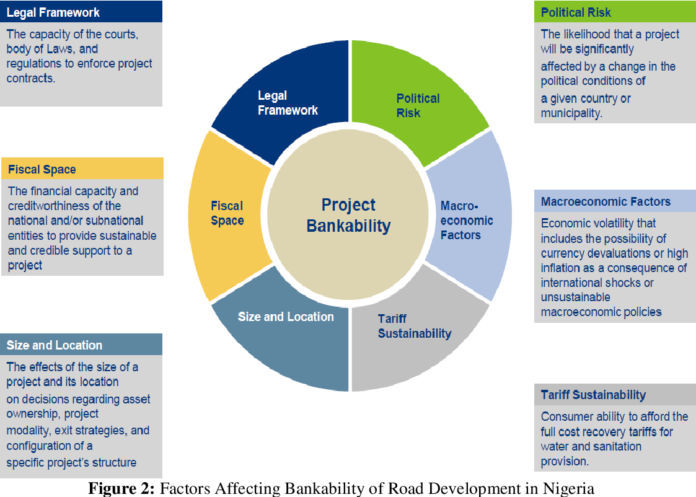

Risk Assessment and Management

- Identifying Potential Risks: Recognizing potential risks that could affect the project’s success.

- Mitigation Strategies: Developing strategies to minimize or manage identified risks.

The Process of Conducting a Bankable Feasibility Study

Initial Research and Data Collection

The process begins with gathering relevant data. Including market research technical specifications, and financial information.

Analysis and Evaluation

The collected data is then analyzed to evaluate the feasibility. Of the project across various dimensions.

Report Preparation

Finally, a detailed report is prepared. Summarizing the findings and providing recommendations for stakeholders.

Benefits of a Bankable Feasibility Study

Decision-Making Support

A BFS provides comprehensive information that supports informed decision-making by stakeholders.

Investor Confidence

By presenting a thorough analysis a BFS instills confidence in potential investors about the project’s viability.

Project Viability Assurance

Ensuring that all aspects of the project are viable reduces. The likelihood of unforeseen issues arising during implementation.

Challenges in Conducting a Bankable Feasibility Study

Data Accuracy

Ensuring the accuracy of data collected is critical. As incorrect data can lead to faulty conclusions.

Unforeseen Variables

Despite thorough analysis, some variables may be unpredictable. Posing challenges to the project’s success.

High Costs

Conducting a BFS can be expensive requiring significant investment in time and resources.

Case Studies

Successful Bankable Feasibility Studies

Examining successful BFS examples provides insights into best practices and strategies for success.

Lessons Learned from Failures

Analyzing failed BFS examples highlights common pitfalls and areas for improvement.

Best Practices for a Successful Bankable Feasibility Study

Detailed Planning

Thorough planning ensures that all aspects of the project are considered and evaluated.

Stakeholder Involvement

Engaging stakeholders throughout the process ensures that their concerns and insights are addressed.

Regular Updates and Reviews

Regularly updating and reviewing the BFS ensures that it remains relevant and accurate.

Future Trends in Bankable Feasibility Studies

Technological Advancements

Emerging technologies are enhancing the accuracy and efficiency of BFS processes.

Sustainability Focus

Increasing emphasis on sustainability is shaping the future of BFS, with greater consideration of environmental and social impacts.

Global Market Dynamics

Globalization is influencing market analysis and competitiveness, requiring more comprehensive BFS approaches.

Conclusion

A bankable feasibility study is a vital tool for assessing the viability of a project. It provides a detailed analysis of market potential. Technical feasibility financial viability and environmental and social impacts. By conducting a thorough BFS stakeholders can make informed decisions mitigate risks and ensure the project’s success. As industries evolve and new challenges arise. The importance of comprehensive feasibility studies will continue to grow.